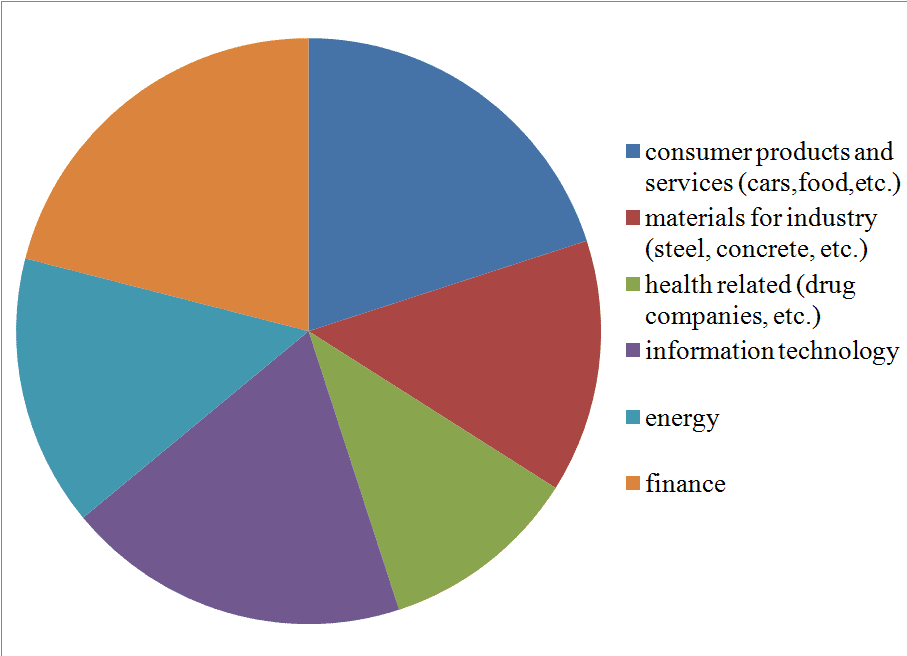

The energy sector has a major impact on the financial sector and close ties to it.

First, the major oil companies and the leading financial institutions are, in large part, run by the same individuals. A large fraction of the members of the boards of directors of oil companies also sit on the board of directors of the large banks and insurance companies that are the oil companies’ principal shareholders. For example, in 2017, of Exxon-Mobile’s twelve directors, nine were also directors of financial institutions: JP Morgan-Chase (2 directors in common), Credit Suisse, Goldman-Sachs, Carlyle Group, Travelers, Guaranty Financial and American Express (3 directors in common).

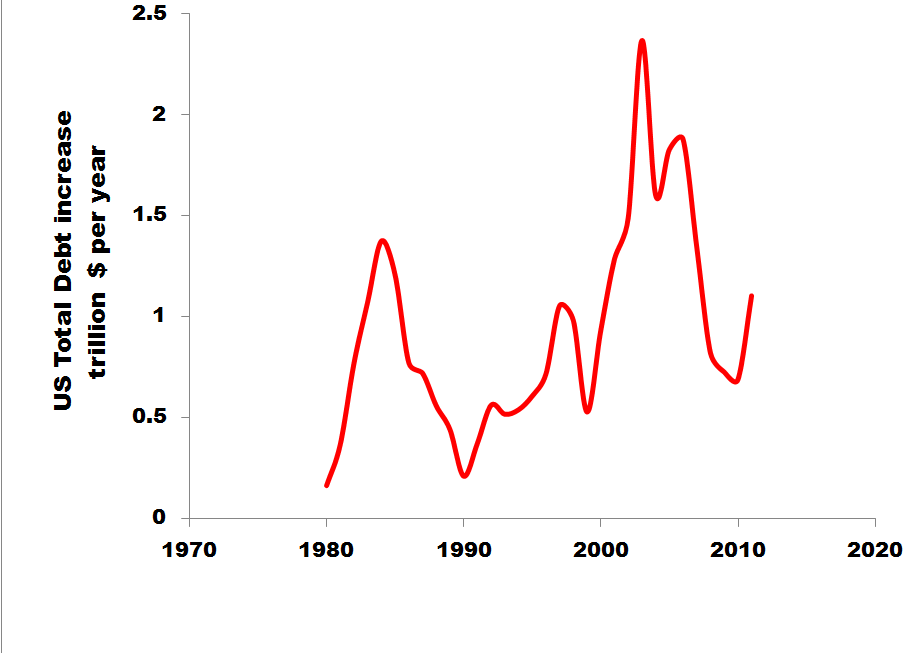

The periods of the most rapid growth in debt in the 1980’s and 2000’s are the same as the periods of high oil prices. The nearly $1 trillion per year paid for increased energy prices during those periods is a large fraction of the $1-$2 trillion in annual new borrowing in the same years.

The global figures, while less detailed, show the same story—during the first decade of the 21st century total world debt climbed by about $5 trillion per year—about as much as the world oil bill at the highest prices that occurred during this period.

The periods of the most rapid growth in debt in the 1980’s and 2000’s are the same as the periods of high oil prices. The nearly $1 trillion per year paid for increased energy prices during those periods is a large fraction of the $1-$2 trillion in annual new borrowing in the same years.

The global figures, while less detailed, show the same story—during the first decade of the 21st century total world debt climbed by about $5 trillion per year—about as much as the world oil bill at the highest prices that occurred during this period.

Of course the rise in debt is more complicated than this, but it is clear that oil price rises have been a major contributing factor and have benefited the bottom lines of both the oil companies and the leading financial firms. Since the majority of both energy and financial stocks are held by the wealthiest 2% of the population, the oil price increases have also contributed to a substantial transfer of wealth from the 98% to the 2%.